- Planet Success

- Posts

- How Banks Work

How Banks Work

Are they a scam?

We need it.

We use it.

We earn it.

Every month. Every year.

And we store it.

In Banks.

Money.

But how did we get there?

The modern banking system is one of the most important and complex institutions in the world.

To understand how it works today, you need to look back at how it developed over the last 200 years.

The Start of Fractional Reserve Banking

In the early 1800s, banks began using a system called fractional reserve banking. This meant that when people deposited money into a bank, the bank didn’t keep all of it.

Sounds like a scam for me…

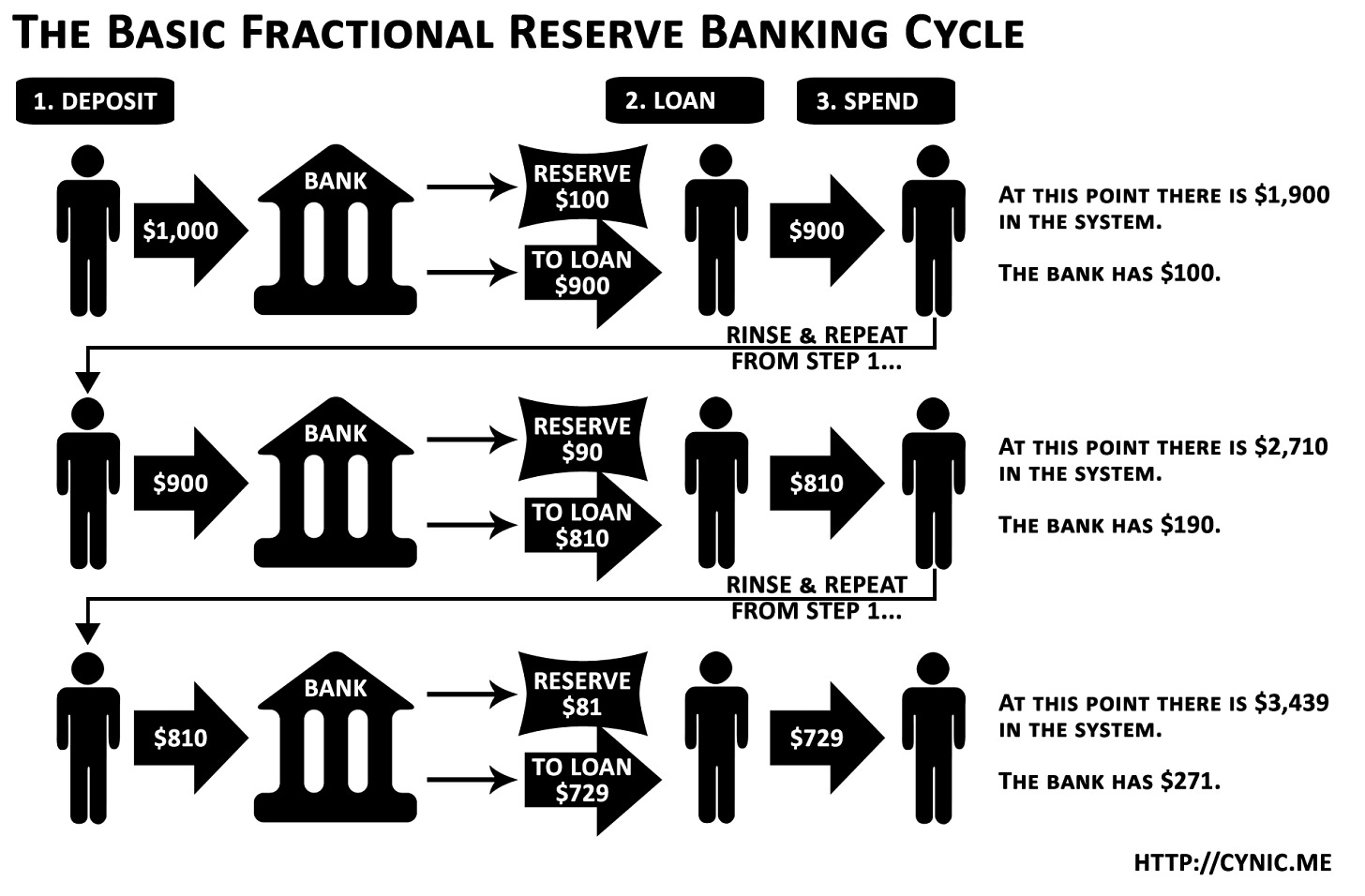

Instead, it held onto a small portion—say, 10%—as reserves and lent out the rest to earn interest. This allowed banks to create more money than they actually had in their vaults.

For example, if someone deposited $100, the bank would keep $10 and loan out $90. That $90 could then be deposited into another bank, which would keep $9 and loan out $81, and so on. This process made the money supply grow far beyond the actual amount of physical cash. It worked well as long as people didn’t panic and try to withdraw all their money at once. If too many people demanded their money, the system would collapse.

Fractional reserve banking helped economies grow because it made borrowing money easier. Businesses could borrow to expand, and we could take loans to buy homes or start companies. BUT, this system also created risks. It relied heavily on trust in the banks, and when that trust broke down, the consequences were ginormous.

The Gold Standard

In the 1800s, most countries used gold as the foundation of their monetary systems. This was called the gold standard.The value of a country’s currency was tied to a specific amount of gold. For example, in the U.S., one dollar was worth a fixed amount of gold, and people could exchange their paper money for gold at any time.

By the late 1800s, the gold standard was used by many of the world’s major economies, including the United States, Britain, and Germany. This system worked for a while, but it became clear that it wasn’t flexible enough to handle major economic crises.

Central Banks

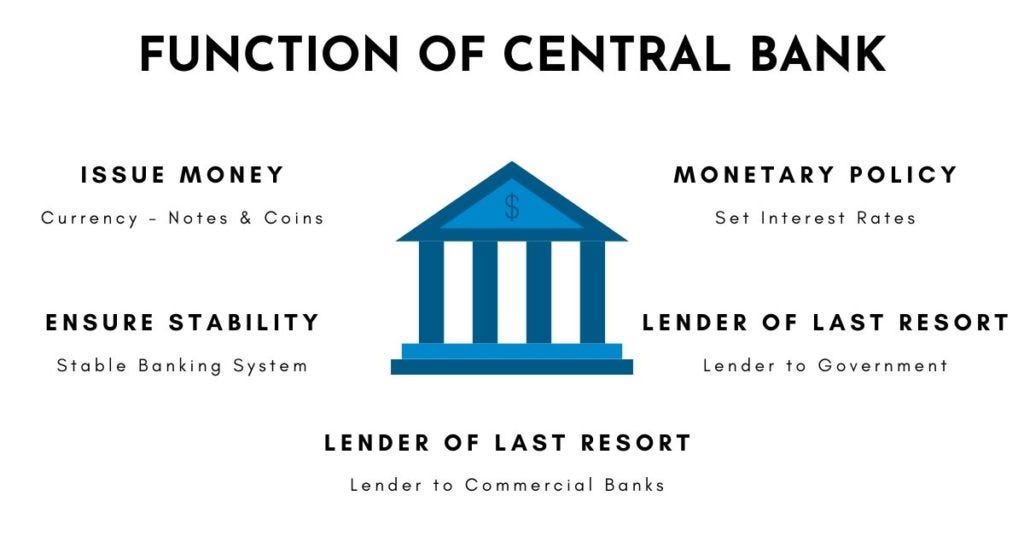

As economies grew and grew and became more complex, it became obvious that someone needed to oversee the banking system and step in during financial emergencies. This led to the creation of central banks. A central bank is a government-backed institution that controls a country’s money supply and helps stabilize the economy.

In the United States, the Federal Reserve (often called “the Fed”) was created in 1913 after a series of financial panics. Its job was to regulate banks, manage inflation, and make sure the economy stayed stable. Central banks like the Federal Reserve became very important for governments to control money and credit.

The Great Depression & the Fall of the Gold Standard

The Great Depression of the 1930s was one of the worst economic crises in history. It showed the weaknesses of the gold standard. During the depression, people and businesses desperately needed money, but because currencies were tied to gold, governments couldn’t print more money to help. This made the economic downturn even worse.

In 1933, U.S. President Franklin D. Roosevelt made a dramatic decision: he ended the right of Americans to exchange their dollars for gold. This allowed the government to print more money.

After World War II, a new system called the Bretton Woods Agreement was created. This tied most countries’ currencies to the U.S. dollar, which in turn was backed by gold. This system worked for a few decades, but by the 1970s, it began to crumble.

The End of the Gold Standard & Beginning of Fiat Money

In 1971, U.S. President Richard Nixon ended the gold standard entirely. The U.S. dollar was no longer backed by gold.

Instead, its value was based solely on trust in the government. This was the beginning of the era of fiat money—currency that has value because the government says it does, not because it is tied to a physical asset like gold.

They could print as much money as they wanted. But, it also introduced new risks, such as inflation. If too much money is created, its value decreases, and prices for goods and services rise.

This system allowed economies to grow rapidly, but it also created a financial system that is heavily dependent on debt. Governments, businesses, and individuals now rely on borrowing to keep the economy moving.

Global Financial Power

As the world moved away from gold, financial institutions gained more influence. Central banks like the Fed and international organizations like the International Monetary Fund (IMF) became quite important players in the global economy.

Plus, I found that private banking families and financial groups, such as the Rothschilds and Rockefellers, played a very big role in shaping the banking system. These powerful families influenced governments, funded wars, and controlled vast amounts of wealth. Over time, the financial system became centralized, with a few key players holding most of the power. The so called Puppet-Masters.

Today, the banking system controls almost every aspect of the economy. Money is no longer physical; most of it exists only as numbers in bank accounts. Banks create money through loans, governments print money through central banks, and global institutions like the IMF coordinate policies across countries.

Money out of thin air.

This system has benefits. But it also has significant downsides.

Be aware and use the system wisely.

Hope I could teach you something new today.

Cheers,

Jonas

Ps: I found the system the rich use to make money WITH dept. Want to know how? Reply or leave a comment and I’ll send it to you.